In a space of one week, shareholders of Microsoft, Amazon, Apple and Netflix lost about N249.3 billion ($600 million) after investors lost confidence in holding the stocks amid US government’s decision to raise bonds rate.

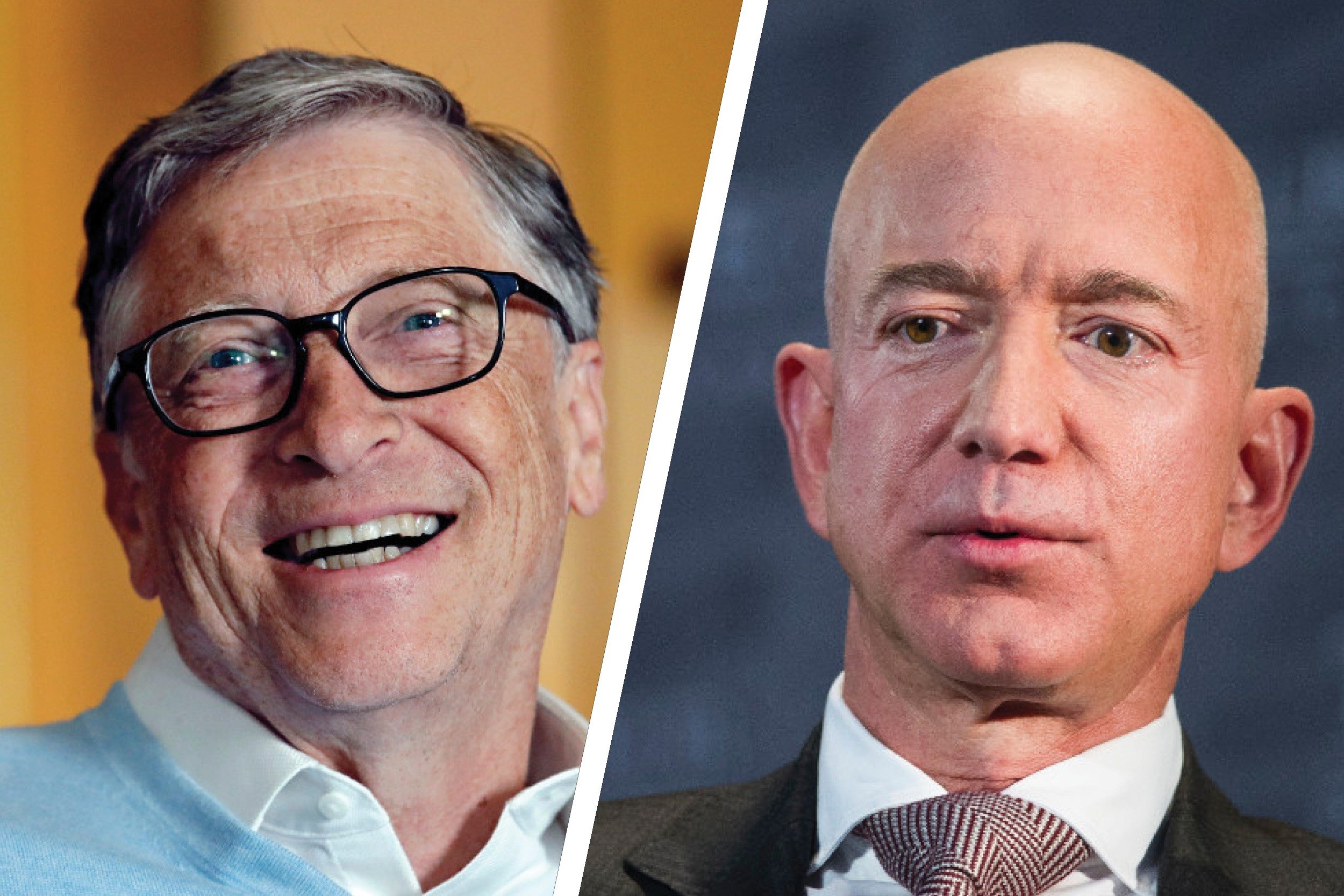

The loss indicated a bad performance for tech companies in the capital market last week, with Jeff Bezos and other Amazon shareholders losing the highest, while Tim Cook and Apple stakeholders came next.

Breakdown of the tech giants’ losses in five days of trading

Trading chart on Nasdaq 100 index, the stock market of the United States, showed that Bezos and Amazon shareholders lost $197.74 billion to pessimistic investors who drove the firm’s stock value down to $2,852.86, from $3,242.76.

The dip in Amazon’s share value depleted the tech giant’s market capitalisation to $1.45 trillion from $1.64 trillion, making the online marketplace the biggest loser among its peers

During the trading week under review, Apple’s market cap declined by 6.16 percent, to push the phone manufacturer’s total investment of shareholders from $2.84 trillion to $2.67 trillion.

This caused a loss of $174 billion to Cook and other shareholders of Apple, following the equity price dwindling to $162.41 per share from $173.07 in five days of trading.

Netflix was the third largest loser, as sell off following an announcement of reduced subscriber growth wiped off $128.70 billion from the total investment held by Reed Hastings and botherbother stakeholders of the streaming companies.

Fear of reduced investment value spiked the sell off which resulted to the market capitalisation heading downward to $1.73 trillion from $1.86 trillion, as investors exit pulled the share price to $2,601.84 from the $2,795.73 it started last week with.

Bill Gates’ Microsoft completed the list with $106.39 billion loss in market capitalisation which depleted due to the price of the company’s share going on sale for as low as $296.03 from last week’s opening of $310.20.

It was gathered that the 4.57 percent decline in stock value knocked the market capitalisation to $2.22 trillion from $2.33 trillion, resulting to the loss recorded by Gates and other shareholders of Microsoft.

Why Bezos, Gates, others are losing funds in the capital market?

The losses are coming amid the US government’s report that yields will return to high interest rate, as Joe Biden’s administration attracts investors to American bonds.

So investors are retrieving their money in securities and asset markets like stocks and cryptocurrencies to enable them have liquidity to invest in the high yields which is expected to commence between Q2 ending and Q3 2022.

This incentive being dangled in front of investors is partly a reason, not only factor, stock value are declining in Nasdaq, which results to loss of millions among investors holding on to some of the stocks for longterm investment.

In order to escape the fall in stock value, shareholders who expect the capital market to turn negative are withdrawing their investment, while investors who share same sentiment are pricing the shares low.